Key Takeaways

- Annuities offer a potential path for small-business owners and self-employed people to have income in retirement.

- While some common retirement strategies are not available to small-business owners, annuities provide a way to grow income that can be converted into a stream of payments that last through retirement.

- There are other options outside of annuities available as well, including SIMPLE IRAs and one-participant 401(k) plans.

Does an Annuity Make Sense for Business Owners?

Annuities can make sense for small-business owners in some circumstances. With most annuities, you hand over either a lump-sum payment to the company issuing the annuity or you can make payments that build up the value of the annuity over time.

The second option can be appealing for small-business owners, since it offers a way to essentially set up their retirement savings.

If you own a small business, you typically don’t have the same access to retirement savings and plans that you would have working for a larger company. Annuities are one path to securing retirement income.

When you eventually retire, your annuity can begin paying out set payments that can last the rest of your life. This helps ensure that you never have to worry about running out of money in retirement or burning through your nest egg.

As old as you get, the payments will keep coming.

Self-Employed Considerations

Self-employed individuals face many of the same concerns as small-business owners when it comes to retirement savings — there are not as many readily available options.

According to a 2019 Pew Charitable Trusts study, only 13% of self-employed workers in single-person firms participate in retirement savings plans through their job, whereas nearly 75% of traditional workers do.

Annuities can work as a potential retirement savings vehicle for those who are self-employed, allowing them to build up savings that can be converted into a guaranteed stream of payments in retirement.

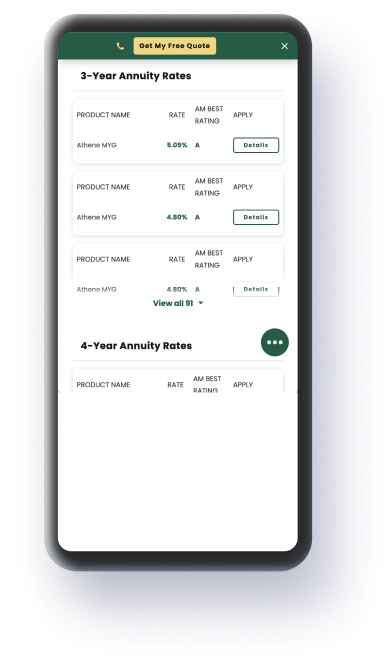

Purchase an Annuity Today

What Should Self-Employed People Look for in an Annuity?

Different annuities serve different purposes, and not all types make sense for those who own small businesses and are self-employed to buy.

For example, some types of annuities make the most sense for those who already have a huge sum of money saved up and are looking to convert it into payments immediately.

There are also annuities that involve high levels of risk and may be unsuitable for those who are looking for secure retirement savings.

3 Things Self-Employed People Should Look for in Annuities

- A moderate level of risk

- Ability to provide security in retirement

- Ability to save money towards retirement

The options that make most sense for self-employed individuals may be those that include enough risk to build up the value of your payments without heavily risking your ability to be secure in retirement.

Read More: First-Time Annuity Buyers

The Best Annuities for Business Owners and Self-Employed People

It’s important to remember that annuities are not a one-size-fits-all. The version and style of annuity that makes the most sense for you may depend on your personal situation and circumstances.

There are several types that stand out as potentially effective options for small-business owners and self-employed individuals.

Deferred Fixed Annuity

Fixed annuities can be an attractive option due to the low level of risk involved. In a deferred fixed annuity, you pay into the annuity and accumulate savings over a set period.

Then, once you are retired, you begin receiving a set stream of payments. Fixed annuities allow for those payments to be consistent with no variation. The pro of this is that it allows you to know exactly how much money you will receive without worrying about any fluctuation.

The con is that it allows for less potential saving, since riskier options can result in larger payouts. But those who are self-employed or owned small businesses may not be looking for a significant amount of risk when it comes to their retirement savings.

Fixed Indexed Annuity

Another version with a little more risk is known as a fixed indexed annuity. This type works similarly to a fixed annuity, but its growth is tied to an index. This allows for some fluctuation in your payments and more gains if the index is performing well. But earnings are typically capped in both directions, so your returns can only fall so far in a down market and grow so high in a strong market.

Single Premium Immediate Annuity

Another type of annuity that can make sense for small-business owners and self-employed individuals who have been saving up money on their own is a single premium immediate annuity, or SPIA.

When you purchase a SPIA, you pay a single lump-sum premium upfront and then begin receiving payments immediately.

This can be a solid way to take your existing savings and convert them into a stream of payments that can keep you secure through retirement. SPIAs can be customized in various ways that can help you grow interest on the annuity in different ways as well.

Read More: Reasons To Buy An Annuity

Let’s Talk About Your Financial Goals.

Alternatives to Annuities for Business Owners

An annuity is just one of many ways that small-business owners or self-employed individuals can help secure income in retirement. In fact, annuities are often used as a supplemental source of money in retirement versus serving as your complete retirement plan.

There are other options and alternatives that may be available to you.

According to the Internal Revenue Service, self-employed individuals may have access to a one-participant 401(k) plan, which can help you save for retirement even if you don’t work for a large company or corporation. It is important to remember that 401(k) plans typically have income limits and annuities often do not.

Another potential option for small-business owners and their employees is a SIMPLE IRA. The Savings Incentive Match Plan for Employees works similarly to other retirement savings plans but doesn’t have many of the associated costs that keep small businesses from being able to make them work.