Key Takeaways

- Legally, you must be 18 to buy an annuity. Many annuity providers have a minimum age limit of 50 and a maximum of somewhere between 75 and 95 years old.

- People who are nearing retirement or newly retired purchase most annuities.

- Those aged 45 to 70 are usually best positioned to buy annuities, but the reasons to do so vary by age group.

- Pre-retirement investors may purchase deferred annuities to maximize growth with tax-deferred treatment, while those already in retirement might choose an immediate annuity to create a guaranteed income stream they can’t outlive.

Annuities provide a fixed income that can give you a steady stream of lifetime payments or payments for a certain period.

The amount of money you receive from this monthly income over your lifetime is determined by the age at which you buy an annuity and your life expectancy. Deciding on the ideal age to buy an annuity depends on your personal lifestyle, financial situation and goals.

Do You Have To Be a Certain Age To Buy an Annuity?

Legally, to buy an annuity you must be at least 18 years old. However, many annuity providers have a minimum and/or maximum age that customers must fall between to purchase an annuity.

Some companies might not want to sell to customers younger than 50, according to Anthony Martin, founder and CEO of Choice Mutual Insurance Group.

“While there are annuity products that younger people can buy, it’s best to look for alternatives to grow your money. The best age to buy an annuity is when you’re in your 70s because that often allows you to maximize the payout,” Martin theorized.

Most annuity providers also set a maximum age to purchase an annuity, usually between 75 and 95 years old. In most cases, you can wait until you’re 95 years old before you must annuitize your contract. And if you start withdrawing from your annuity before you turn 59 ½, you may face a 10% early withdrawal penalty from the IRS.

Your goals rather than your age should be the primary factor you consider when deciding whether to buy an annuity, but your age plays a part. Annuities generally make more sense the older you are, although your risk tolerance plays a large role regardless of your age.

What’s the Best Age To Buy an Annuity?

“The ‘best’ age to buy an annuity is highly individual, as it depends largely on personal circumstances and financial objectives,” Mike Muffoletto, Certified Financial PlannerTM professional and vice president of Clark & Company Wealth Management, told Annuity.org.

Muffoletto pointed out that the guaranteed returns and reliable income stream that annuities provide make them ideal for individuals in or nearing retirement. In general, the younger you are, the less likely annuities make sense and the more likely you should consider alternatives to annuities.

“It really kind of depends on the annuity investor, but I’d say that sweet spot is anywhere from 45 to 70 years old,” Joe Liekweg, a licensed agent at Insuractive, told Annuity.org.

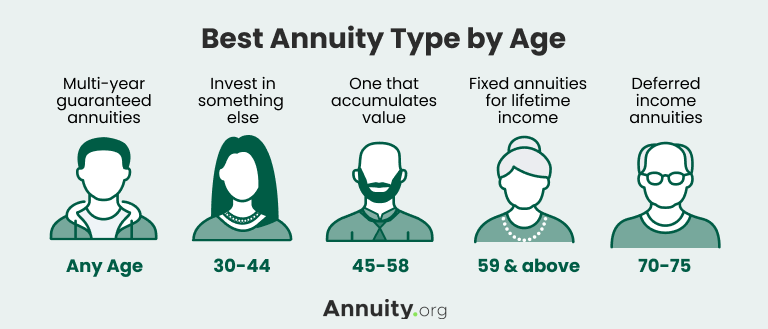

When buying an annuity, your age can play a large role in the type of annuity you’re best suited for.

- At Any Age

- A multi-year guaranteed annuity (MYGA) may be an option for anyone at just about any age because these types of annuities guarantee interest. MYGAs “can beat the bank and give you a better return than letting the money sit in a savings account or CD,” Liekweg said.

- Ages 30 to 44

- If you’re on the younger end of the age spectrum, also consider alternative financial products when planning your retirement. Consider that you will have limited access to your money once it’s been used to purchase an annuity. If you are in your 30s or 40s, this is money that you might prefer to put into retirement investments with greater risk but potentially greater payoff.

- Ages 45 to 58

- People in this age group can benefit from an annuity buying strategy aimed at accumulating value before retirement. This is especially true if you are thinking about moving over qualified money — money that’s never been taxed — such as from certain retirement accounts like 401(k)s and IRAs.

- Ages 59 and Above

- Because of withdrawal penalties that expire when you turn 59 ½, buyers in this age group are likely to benefit from buying an annuity for lifetime income and tax deferment. This is especially true if they are moving qualified money into an annuity.

- Ages 70 to 75

- Many financial advisors suggest age 70 to 75 may be the best time to start an income annuity. A deferred income annuity typically only requires 5% to 10% of your savings and it begins to pay out later in life. It’s a hedge against outliving your retirement portfolio, providing you with guaranteed income later in life.

Annuity Types To Consider at Different Ages

These are simply examples of different types of annuities to consider at different stages of life.

“In some cases, it can make sense to buy an annuity in your 40s, while in other cases it can be a perfectly valid strategy to buy an annuity at 75 or even older,” said Certified Financial Planner™ professional Matt Frankel. “It all depends on your situation, goals and risk tolerance, so the best move is to consult with a financial planner who can evaluate your options.”

Read More: First-Time Annuity Buyers

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

How To Know If You’re Ready for an Annuity

To figure out whether you’re ready for an annuity, consider your current financial situation. Do you have the cash savings available to purchase an annuity with a lump-sum premium? For many, having to pay for an annuity all at once or even with a few payments can be an obstacle.

You might also think about how your future finances will be impacted by the annuity. How soon will you need the annuity’s income payments? Do you expect to live long enough to get the full benefit out of your annuity?

Questions To Consider

When thinking about the type of annuity you want and when you’ll be ready to purchase it, here are a few questions to ask yourself.

- 1. When will you need the money?

- Do you need the money now, or can you afford to have limited access for a period of time? Answering this for your situation will help you decide which type of annuity to buy. You can buy a single premium immediate annuity with a lump-sum payment and get a steady income right away, or you can choose to purchase a deferred annuity that will provide money later on.

- 2. How much will it cost?

- The type of annuity you choose will determine the cost. Add-ons and extras, called riders, also affect the price. Make sure you ask about commissions and fees, which are usually included in the purchase price or reflected in the payments.

- 3. What’s your life expectancy?

- How long you’re expected to live factors into the return on your annuity. Consider your health and gender, and how they affect life expectancy. If you are healthy and your family has a history of living longer, you’ll need to determine if the annuity’s income stream will keep up with inflation over time. If your life expectancy is shorter, is the payout too little?

- 4. What are your risks?

- An annuity income stream that fails to keep up with inflation is one of the biggest risks to consider when choosing the right annuity for you. Also consider the fact that you will have limited access to your money and any potential growth you may have otherwise experienced in exchange for the income from an annuity.

- 5. Will the annuity work well with your other income?

- Consider all your other retirement income sources like Social Security payments, government or private pensions, 401(k) plans, IRAs or other retirement savings plans. Before buying an annuity, think about how all these investment vehicles will work together to holistically address your retirement needs. If this sounds overwhelming, consult with a fiduciary financial advisor.

5 Questions To Ask Yourself Before Buying an Annuity

Purchase an Annuity Today

Alternatives to Annuities

Although an annuity is a beneficial way to create income in retirement for many, it may not be the right product for everyone. Younger investors in particular may benefit from alternative investment choices.

Investors who are below the optimal age range for annuities have a wealth of other investment options to choose from. Which investments are right for you depends on your financial circumstances and priorities.

Linda Chavez, an independent life insurance agent, recommended investing in retirement accounts like a 401(k) or IRA. “These retirement accounts allow you to invest in a variety of different assets, including stocks, bonds and mutual funds,” Chavez told Annuity.org.

If you have children, you might consider starting a 529 plan to begin saving for their education. “This is a tax-advantaged savings account that can be used to save for college expenses,” Chavez explained.

Another good alternative is a variable life insurance policy, according to Martin. “It’s tied to investments, so there’s an opportunity to grow your money, although there are some risks involved because of market fluctuations,” Martin said.

Read More: Reasons To Buy An Annuity

Join Thousands of Other Personal Finance Enthusiasts

FAQs: Best Ages To Buy an Annuity

When to buy an annuity can depend on the type of annuity you’re considering and your financial goals. Many financial professionals suggest the best time to start an income annuity is around the time you retire, typically 70 to 75 years old. This allows you to buy before the maximum age limit set by some annuities while still maximizing your annuity payout.

You might consider an alternative to annuities if you already have a steady, guaranteed stream of income that covers your expenses, such as sufficient Social Security and pension benefits.

Most people buy an annuity to provide an income stream in retirement. By waiting until you retire, you can convert part of your retirement savings into an annuity at a point in your life that gives you the best payout from the annuity.