Key Takeaways

- Annuities may not be the best fit for everyone because of their complexity, fees or lack of liquidity.

- Alternatives to fixed annuities include bonds, certificates of deposit, dividend-paying stocks and mutual funds.

- The right investment strategy depends on various factors, including your financial goals and risk tolerance. Consult with a trusted financial advisor before choosing.

Annuities are among the safest options for long-term financial planning. They offer a reliable and steady stream of regular payments, making them an attractive choice for those looking to fund retirement, provide for loved ones or even cover long-term care costs.

But, like any investment strategy, annuities carry some risk and may not be the best financial planning choice for everyone. Fortunately, there are several sound alternatives to annuities that also generate income.

Before investing in an annuity or any other type of investment, you need to identify and prioritize your objectives. Most investors are focused on some combination of ensuring liquidity, preserving capital, generating income, fueling growth and fostering diversification. I recommend working with a fiduciary financial advisor to complete this exercise. He or she can help you assess things in a holistic, risk-focused manner.

Why Might an Annuity Not Be the Best Fit?

Annuities can be a powerful tool in a long-term financial strategy, but they are not a one-size-fits-all product. While there are many ways to customize your benefits depending on the type of annuity you choose to buy, certain characteristics of annuities may not align with your financial goals, risk tolerance or liquidity needs. Some consumers also have concerns about their complexity, commissions and fees, and taxation rules.

Let’s delve into some real-world reasons why an annuity might not be the ideal fit.

- You need to quickly access funds for large or emergency expenses.

- Annuities are meant to be long-term contracts, and they may carry early withdrawal penalties and fees for receiving funds ahead of or in excess of your scheduled payment amounts.

- You prefer a more aggressive investment strategy with higher return potential.

- Unlike other types of investments, annuity contracts transfer market risk to the insurance company. Fixed annuities, for example, provide a guaranteed rate of return regardless of market volatility. So for younger investors with longer time horizons and higher risk tolerance, annuities might not be the most fitting strategy.

- You are confident that your existing funds will cover all your income needs in retirement.

- If your existing sources of assured income will cover your expenses for the rest of your life, then you may not need to add an annuity. AARP shares four factors for determining how much you will need after you retire which may help you assess your position.

An annuity might not work for you if:

Remember that annuities are insurance products. As Moshe A. Milevsky, professor of finance at York University and managing director of the private consulting firm PiLECo, told Annuity.org, “Like any other insurance policy that consumers own, it’s important for everyone to have enough insurance — but not too much.”

On average, people need to replace about 75% of pre-retirement income for living in retirement. Social Security retirement benefits replace about 40% of income after retiring for medium-average earners.

If you already have many other forms of guaranteed income, like a large pension from work or ample income from Social Security, Milevsky advises that an annuity might not be needed.

Best Alternatives to Annuities

Beyond annuities, there are several alternatives to consider for peace of mind and financial security. Like annuities, these alternatives come in many forms depending on your investment goals and risk tolerance. They also come in fixed and variable options.

A Note on Safety-First Retirement

Many annuity alternatives still fall within the safety-first approach to retirement planning made popular by economist Zvi Bodie. This approach prioritizes funding basic needs over discretionary spending. Because of that, Bodie and other safety-first proponents advise people to cover their essential retirement expenses with guaranteed sources of money, including lifetime annuities, Social Security, a pension, bonds and CDs.

Wade Pfau, a professor of retirement income at The American College of Financial Services, describes this approach as first building a “safe and secure income floor” for your entire retirement. Only then, he believes, should people consider more volatile assets in their retirement portfolio.

How soon are you retiring?

What is your goal for purchasing an annuity?

Select all that apply

Alternatives to Fixed Annuities

Some of the most popular alternatives to fixed annuities are bonds, CDs, retirement income funds and dividend-paying stocks. Like fixed annuities, these investments are considered relatively low risk and offer regular income.

Bonds

A bond is essentially a loan that you make to a borrower, usually a corporation or government, in return for a specified rate of interest and a guarantee that you will receive the principal back after a set time.

Bonds are generally considered safe and liquid investments. There are different types of bonds, including U.S. Treasuries and municipal bonds, with different yields depending upon the lender and interest rates.

While it is difficult to compare annuities to bonds, many experts say annuities are a better choice than bonds for generating income and have shown they can outperform bonds in retirement portfolios.

Interest rate changes can affect a bond’s value, and bond prices decline when interest rates rise.

Certificates of Deposit

A certificate of deposit (CD) is a special type of savings product offered by banks and credit unions with higher interest rates than traditional savings accounts. In exchange for receiving the interest earned, you agree not to access the account for a set amount of time.

CDs are considered a very safe investment because they are backed by the Federal Deposit Insurance Corporation up to $250,000 for individual accounts. Like fixed annuities, CDs have a guaranteed rate of return and guarantee on the principal.

But comparing annuities to CDs is not apples-to-apples. Typically, CDs are seen as shorter-term investments and their interest is taxed annually. On the other hand, annuities are longer-term investments that offer tax-deferred growth.

The Consumer Financial Protection Bureau advises you to select your CD maturity date based on your expected needs. If you remove money ahead of this date, you could pay penalties or forgo interest earnings.

Fixed Annuities vs. Bonds vs. CDs

| Type | Taxation | Principal Protected? | Interest |

| Fixed Annuity | Tax-deferred growth | Preset/guaranteed | |

| Bond | Interest income may be taxed or tax-free | Most pay fixed rate of interest, but subject to interest rate risk | |

| Certificate of Deposit | Interest income taxed | Preset/guaranteed |

Retirement Income Funds

A retirement income fund (RIF) is a mutual fund that takes a conservative investing approach. These funds typically hold a mix of fixed-income securities and equities with the goal of consistency rather than maximum gains. RIFs are sometimes referred to as managed payout funds.

Proponents of RIFs like their simplicity and all-in-one offerings. They are designed to produce steady returns with regular payouts and have higher return potential than more conservative annuity alternative strategies like CDs or bonds alone.

But because they are exposed to market risk, RIFs do not guarantee returns. Additionally, to meet your payout schedule, some fund managers may be allowed to access your principal.

While retirement income funds can offer more flexibility than annuities, they do not offer payment guarantees.

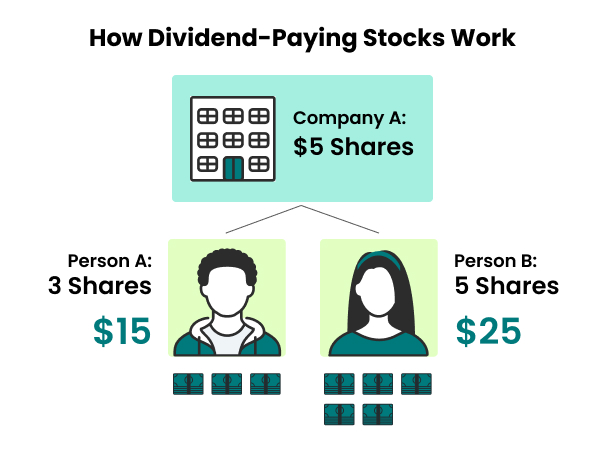

Dividend-Paying Stocks

Dividend-paying stocks are equity securities that distribute earnings regularly. They are a type of passive income and tend to be more reliable than growth stocks.

FINRA says dividend-paying stocks historically outperform other stocks during market volatility and downturn because they are perceived as “safer” investments. Experts and financial advisors also credit dividend-paying stocks as an investment tool to protect against inflation.

Read More: Variable Annuities vs. Stocks

Alternatives to Variable or Indexed Annuities

Indexed and variable annuities carry a higher risk than fixed annuities because at least a portion of their income is tied to market performance. The most popular alternative to variable or indexed annuities function like mutual funds, but can provide minimum guarantees.

Variable Life Insurance

Like an annuity, a variable life insurance policy is a contract with an insurance company that allows for tax-deferred growth. It is intended to provide income for your family or other beneficiaries upon your death.

Variable life insurance policies also have cash values that vary according to the policy’s fees and expenses, the premiums you pay and the performance of the money in investment accounts (typically mutual funds). You may be able to put a portion of your premiums into a fixed account that provides a guaranteed minimum.

There are several factors to consider:

- Ensure that you can afford the fees and expenses charged to maintain the policy. Some fees could increase over time. If you cannot pay them, your policy could terminate.

- Understand the risk-return tradeoff associated with your investment selections. Higher returns necessitate the assumption of greater risk and a higher possibility of losing money.

- Assess the financial strength of the insurance company. If it goes under, your investment could be lost.

- Determine whether special features offered under the policy could be purchased more cheaply separately.

Source: U.S. Securities and Exchange Commission

The U.S. Securities and Exchange Commission also cautions that the federal and state tax rules that apply to these insurance policies can be complicated. It’s wise to consult a tax advisor before purchasing a policy.

A Combined Approach

As with any financial planning strategy, consider all options before making any final decisions about the right savings strategy for you.

Most financial planning exercises do not entail “all-or-nothing decisions, Milevsky believes. “You don’t have to go ‘all in’ and can diversify across various products — some annuity, some not.”

For many, the best solution might be a combination of several income-producing investments to meet financial goals and plan for a secure retirement.

Join Thousands of Other Personal Finance Enthusiasts

FAQs About Annuity Alternatives

When planning for retirement, you have various alternatives to annuities. Each comes with unique advantages and features. Explore options like 401(k)s, IRAs, dividend-paying stocks and retirement income funds. Choosing the right option for you will rely on your financial goals and individual situation.

Among the reasons to buy annuities is the fact that they provide long-term growth and a steady income stream with relatively low risk.

An annuity may be a good investment choice for people already heavily invested in stocks or bonds. Annuities provide added diversification by providing an income stream that’s (typically) not dependent on stock market performance.