Key Takeaways

- Annuities can make sense for women as a way to grow their savings and guarantee a stream of income in retirement.

- Women are less represented in the workforce than men and also make less money on average. This means they can fall behind in retirement savings.

- Annuities can be a more beneficial investment for women since they live longer, on average, than men. Annuity payments last your entire life once they start.

How Annuities Can Benefit Women

Saving for retirement is critical to ensuring financial security later in life. But, due to economic circumstances and a job market where men are more represented, many women do not have the retirement savings that they need.

According to the U.S. Census Bureau, 50% of women aged 55 to 66 have no personal retirement savings. In comparison, 47% of men do not have personal retirement savings.

Multiple factors have contributed to this issue, including the fact that women make less money when employed.

In the years following the COVID-19 pandemic, the U.S. Bureau of Labor Statistics observed that the pandemic also worsened existing issues by causing the share of women in the workforce to fall to 56.2% in 2020, the lowest rate since 1987.With fewer women working, and those who do work making less money than men on average, there are fewer opportunities to put away money for retirement.

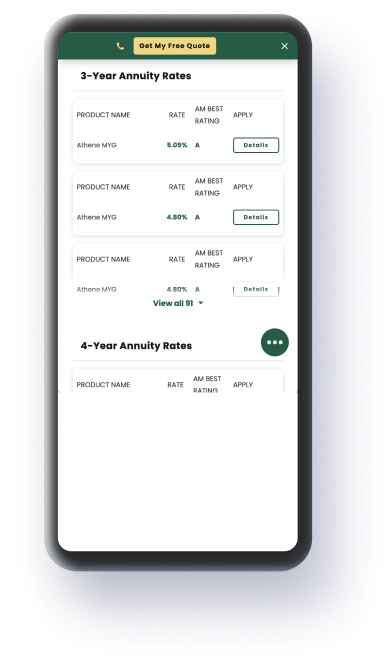

A non-traditional savings option like an annuity can help to bridge that gap in some circumstances. You can pay into annuities like a retirement account or 401(k) with the value increasing over time.

When you retire, you can then convert the annuity into a stream of payments guaranteed to last the rest of your life.

Unique Retirement Circumstances

There are several retirement circumstances unique to women that can make buying an annuity an appealing option.

One potential benefit for women stems from the fact that they live longer than men on average. According to the Harvard Medical School, women have a life expectancy of 79.1 years, while men have a life expectancy of 73.2 years.

Remember that once an annuity is converted into a stream of payments, it will pay out for the rest of your life. So, women stand to gain even more money from an annuity than men.

Say that you have an annuity that pays out $3,000 per month beginning at the age of 65. A man who lived to the average life expectancy age of 73 would receive $288,000 from the annuity over that span.

But a woman who lived to 79 would receive $504,000 thanks to those additional years of life. So, annuities can actually be a stronger investment with a higher return for women.

Why Annuities Can Be Effective for Women

- Women live longer than men on average and can get more from their investment since annuity payments last your entire life.

- Women are represented in the workforce at a lower rate than men and make less money than men, resulting in decreased access to traditional retirement saving strategies.

- Annuities generally do not have a contribution limit, allowing women to catch up on their savings at a faster rate.

Annuities can also appeal since they rarely have a contribution limit like a 401(k). If a woman had to leave the workforce for an extended period, an annuity can be a way to make up for that lost time by contributing more than what would result from starting a 401(k) or similar plan later in life.

Read More: First-Time Annuity Buyers

Purchase an Annuity Today

Types of Annuities That May Work Best for Women

Annuities come in many different forms. Some come with lots of risks, while others are steadier options. There are also annuities that pay out immediately and other choices that build up value over many years.

The type of annuity that makes the most sense will likely depend on your personal situation. But there are several particular types that may make sense for women looking to save for retirement.

Fixed Annuities

Fixed annuities can make sense as a low-risk way to build up the value of your annuity. As the name implies, this type of annuity grows at a fixed and predictable rate, ensuring that you have growth but don’t have to worry about the value of your annuity declining or not ending up where you expect.

This type of annuity can make sense if you are hoping to build up retirement savings. There are other more aggressive options as well, such as variable annuities or indexed annuities.

These styles include more risk by either investing your contributions or tying them to the performance of an index. There is potential for greater gains but there is also significantly more risk.

Depending on your goals and how much you are looking to save, a fixed annuity may make more sense as a safer option.

Deferred Annuities

Annuity payment timelines can differ and generally fall into two broad categories: immediate and deferred.

Immediate annuities begin their stream of payments immediately after you purchase the annuity, usually because you bought it with a lump sum of cash.

This is why deferred annuities may make more sense for retirement savings. In this style of annuity, you pay into it over time.

Then, after it has built up value over years, it is converted into a stream of payments that lasts for years.

This allows you to build up your retirement savings for years before turning those savings into payments that will support you financially for the rest of your life.

Read More: Reasons To Buy An Annuity

Alternatives to Annuities for Women

Annuities are a solid option to help women impacted by the wage and employment gap take full advantage of their longevity financially.

But annuities don’t automatically make sense for everyone. There are other traditional options that can make sense as well.

If a 401(k) is available as an option, it can be a potentially strong path to take. Employers often match contributions up to a certain amount, giving 401(k)s the ability to grow steadily in value over years.

Another option is an individual retirement account or IRA. You open this type of account through a bank instead of an employer, offering you a chance to save for retirement even if your job does not offer a 401(k). IRAs can be tax-deferred.

Regardless of which option makes the most sense for you, it’s important to remember that it often takes decades to save effectively for retirement. Any of the available options likely need time in order to grow your savings.