Sagicor Life Insurance Company, or Sagicor Life, is licensed in 45 states and the District of Columbia. The company is not fully licensed in Alaska, Connecticut, Maine, New York or Vermont.

The company is a wholly owned subsidiary of Sagicor Financial Company Limited, or Sagicor Financial. Sagicor Financial operates in 19 countries, primarily in the United States, the Caribbean and Latin America.

About Sagicor

Sagicor was founded in 1954 as American Founders Life Insurance Company in Austin, Texas. The annuity company grew over the years through acquisitions, and in 2005, Sagicor Financial Company Limited purchased American Founders Life Insurance Company.

As a result, the organization officially became Sagicor Life Insurance Company and evolved into an international financial services corporation.

After the first quarter of 2022, Sagicor reported over $680 million in revenue. Approximately 76% of that revenue was from life, health and annuity insurance issued to individuals.

Sagicor ranks among the top 150 life insurance companies in the U.S. based on the company’s invested asset position.

Sagicor specializes in the following business lines:

- Annuities

- Asset management

- Auto insurance

- Banking

- Business insurance

- Health insurance

- Home insurance

- Life insurance

According to the company website, Sagicor’s vision is “to be a great company committed to improving the lives of the people in the communities in which we operate.”

Sagicor aims to be a “timeless, borderless and colorless company” through its business procedures and relationships.

If you’re an existing annuity customer with Sagicor, you can reach their Client Services team at the following number:

1-888-724-4267, extension 4610

Credit Ratings

Credit rating agencies provide a standardized scoring system for insurance companies. These ratings help consumers determine if the provider can feasibly cover its financial obligations and cover claims.

AM Best rated Sagicor an A-, which is the fourth best out of 16 possible ratings. Fitch Ratings gave Sagicor Financial a BB, while S&P Global Ratings gave the company a BB+.

Regarding the BB and BB+ ratings from Fitch and S&P Global Ratings, Sagicor explains on its website that “in 2016, Sagicor Financial redomiciled to Bermuda from Barbados after a series of downgrades impacted the Barbadian sovereign rating and so unduly impacted Sagicor Financial.”

Sagicor Credit Ratings

| Credit Rating | Outlook | |

|---|---|---|

| AM Best | A- Excellent |

Stable |

| Fitch Ratings | BB Speculative |

|

| S&P Global Ratings | BB+ Speculative |

Annuity Products Offered by Sagicor

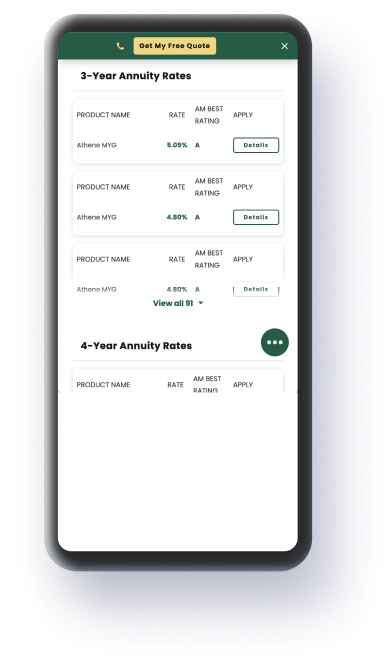

Sagicor currently issues three categories of annuity products: multi-year guaranteed annuities, single premium immediate annuities and single premium deferred annuities.

Multi-Year Guaranteed Annuities (MYGA)

MYGA products grow with a guaranteed rate of interest over a chosen period of time. Consumers can choose from five guarantee periods — three, four, five, six or seven years — and earnings are tax-deferred.

The Milestone MYGA is Sagicor’s product line with multi-year fixed interest rates.

Single Premium Immediate Annuities (SPIA)

Immediate annuities begin paying out within 12 months of purchasing the annuity. After paying a single premium, you secure a guaranteed income stream while assuming no market risk with Sagicor’s SPIA product.

Single Premium Deferred Annuities

Deferred annuities are designed to accumulate earnings over time so that funds can be distributed in the future. These earnings grow tax-deferred, so you do not owe taxes on gains until you begin receiving payments.

Sagicor offers the Sage Choice Single Premium Deferred Annuity with a competitive fixed interest rate.

Purchase an Annuity Today

Client Resources

Sagicor has a list of frequently asked questions on its website with responses to common questions such as, “Can I have my premium payment automatically withdrawn from my bank account?” Clients can also access the Sagicor client portal to view policy details, pay premiums and upload forms.

According to its website, Sagicor is committed to community engagement, sponsoring the Triple-Impact Competitor scholarship program to provide resources to youth and high school sports teams. The company also contributes to the Arthritis Foundation, Phoenix Children’s Hospital and other worthy causes.

If you have an annuity with Sagicor, you can log into your account at:

About Annuity.org

Annuity.org has provided reliable, accurate and trustworthy financial information to readers since 2013. We partner with professionals like those from Senior Market Sales (SMS), a market leader with over 30 years of experience in the insurance industry, to offer personalized retirement solutions for consumers across the country.

Any information offered about the company above is provided free of charge and individual product offerings are verified and accurate as of publication.

Our partners work with the provider companies mentioned on our site. However, Annuity.org is not a service provider. Actual products, terms and rates offered through the above company are subject to in-state availability and a variety of other factors. Visit the Our Partners page for additional information.