About Oceanview Life and Annuity

Oceanview Life and Annuity Company is based in Phoenix, Arizona. The company holds a strong reputation as a trusted annuity provider. Oceanview’s executive leaders come from extensive backgrounds in the financial services industry, working at businesses such as annuity insurers, consulting firms and global banks.

The company website’s “Our Story” page describes Oceanview Life’s vision: “To expand the pool of investors in the U.S. that use fixed annuities as an element of their overall financial portfolio to generate attractive tax efficient returns.” To achieve this vision, Oceanview Life and Annuity seeks to provide annuities with competitive returns, easy-to-understand features and a thoughtful investment approach.

Current Oceanview Life and Annuity policyholders can contact the company’s administrative office at the following number: 1-888-295-3815

Oceanview Life and Annuity Company isn’t as well known as some of the larger players in the annuity market, but the firm is making inroads, largely due to its competitive returns and high-quality products.

Credit Ratings

Annuity companies such as Oceanview Life and Annuity receive scores based on their overall financial stability. These scores are called credit ratings or financial strength ratings and are issued by independent agencies. The higher a rating the annuity provider receives, the more stable they are financially and the better chance they have of meeting their obligations.

Oceanview Life and Annuity has received a financial strength rating from one of the most renowned credit rating agencies, AM Best. The agency’s 2022 financial highlights update affirmed Oceanview’s rating as A-, which signifies an “Excellent” financial strength score. The update also confirmed that Oceanview had over $3.6 billion of assets as of December 31 2021. AM Best also revised the outlook of Oceanview Life and Annuity to positive from stable, citing the company’s very strong balance sheet and appropriate enterprise risk management.

Annuities Offered by Oceanview Life and Annuity

Oceanview Life and Annuity specializes in fixed annuity products. These annuities earn a guaranteed rate of interest during an accumulation period before converting the value of the contract into a stream of income payments. Oceanview sells two types of fixed annuities: multi-year guaranteed annuities and fixed index annuities.

Multi-Year Guaranteed Annuities

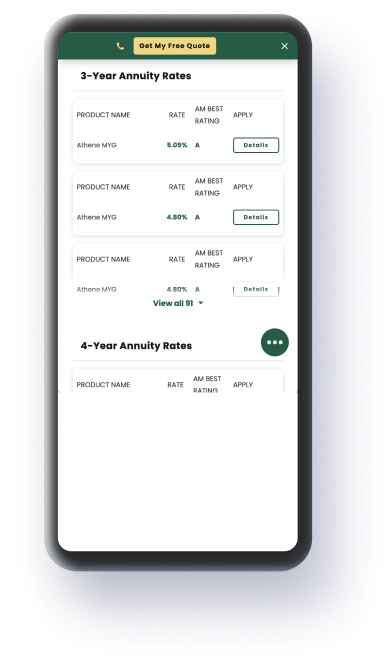

Oceanview’s Harbourview and Sky Harbourview annuity series are what’s known as multi-year guaranteed annuities (MYGAs). When you purchase a MYGA, the interest your contract will earn is locked in for the duration of the annuity’s term.

The Harbourview Fixed Annuity series offered by Oceanview lets customers choose from periods of two, three, four, five, six, seven and 10 years. The Sky Harbourview series allows for a three-year, five-year, seven-year or 10-year period. Both MYGA series also feature death benefits and spousal continuation options.

Fixed Index Annuities

In addition to MYGA annuities, Oceanview Life and Annuity also provides fixed index annuities (FIAs). These annuities earn interest based on two factors: a minimum fixed interest rate that’s guaranteed for the contract (1% for Oceanview’s FIA products) and a cap rate that’s tied to the performance of an equity market index like the S&P 500.

Oceanview Life and Annuity’s FIA products provide premium protection along with maximum growth potential. The contract on the FIA also allows you to withdraw up to 10% of your annuity’s value each year without penalty after the first year of the contract.

Purchase an Annuity Today

Client Resources

Oceanview Life and Annuity’s online Resource Center helps annuity customers find what they need. Oceanview customers can browse the glossary to better understand the complexities of an annuity contract. Frequently asked questions are also available on the Resource Center’s FAQ page.

Oceanview also gives customers access to download relevant annuity paperwork online including:

- Applications

- Brochures

- Change of Beneficiaries Form

- Death Claim Form

- Letter of Intent

- Partial/Full Withdrawal Form

- Request for Copy of Contract

- Transfer Form

If you have an annuity with Oceanview Life and Annuity, you can log into your account at: Oceanview’s Client Portal

About Annuity.org

Annuity.org has provided reliable, accurate and trustworthy financial information to readers since 2013. We partner with professionals like those from Senior Market Sales (SMS), a market leader with over 30 years of experience in the insurance industry, to offer personalized retirement solutions for consumers across the country.

Any information offered about the company above is provided free of charge and individual product offerings are verified and accurate as of publication.

Our partners work with the provider companies mentioned on our site. However, Annuity.org is not a service provider. Actual products, terms and rates offered through the above company are subject to in-state availability and a variety of other factors. Visit the Our Partners page for additional information.