About Lincoln Financial Group

Lincoln Financial Group (LFG) was founded as the Lincoln National Corporation in 1905. By 1933, the company had over $1 billion of active insurance policies. LFG managed to survive the trials of the Great Depression and continued to grow, becoming the ninth-largest insurance company in the U.S. by 1955.

The company has kept up this growth over time, and today remains one of the largest insurance companies in the country. According to their website, Lincoln Financial Group “has helped millions of people find peace of mind while planning their finances, buying insurance, choosing employee benefits and saving through workplace retirement plans.”

In addition to providing annuities, Lincoln Financial Group offers life insurance, retirement plans and employee benefit plans for businesses.

Current Lincoln Financial Group annuity holders can reach out to the company with questions using one of the following toll-free numbers (depending on the type of annuity product):

For American Legacy® variable annuities: 800-942-5500

For Lincoln Choice PlusSM and individual variable annuities: 888-868-2583

For Lincoln Level AdvantageSM indexed variable annuities: 877-737-6872

For fixed and indexed annuities issued April 1, 2011 or after: 888-916-4900

For fixed and indexed annuities issued prior to April 1, 2011: 800-950-2454

Lincoln Financial Group is a massive financial institution, with revenues approximating $20 billion for the year 2021. This includes nearly $12 billion in annuity sales, a figure that underscores the firm’s experience in this space.

Credit Ratings

Before you purchase an annuity, check the credit ratings of the company you wish to purchase from. These ratings tell you how financially stable the provider is, giving you confidence in the company’s ability to fulfill its end of the annuity contract.

Lincoln Financial Group holds high credit ratings from the four major credit rating agencies. Three of these agencies categorized the company’s outlook as stable, while one scored the company’s outlook as negative.

Lincoln Financial Group Credit Ratings

| Credit Agency | Rating | Outlook |

|---|---|---|

| AM Best | A+ | Stable |

| Fitch | A+ | Stable |

| Moody’s | A1 | Stable |

| S&P Global Ratings | AA- | Negative |

Annuity Products Offered by Lincoln Financial Group

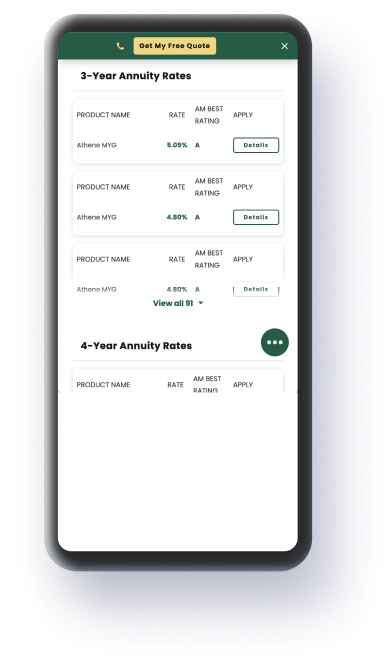

Lincoln Financial Group offers consumers one of the broadest portfolios of annuity products available in the country. The types of annuities LFG issues include fixed, income, multi-year guaranteed, fixed index and variable annuities. Each annuity’s rates may vary depending on the product type and location.

Fixed Annuities

LFG’s Lincoln MYGuaranteeSM Plus single premium deferred annuity converts a lump sum of savings into a guaranteed income stream that pays out monthly. Like most fixed annuities, this product earns a fixed interest rate that the annuity holder agrees to when the contract is signed.

Income Annuities

The Lincoln Insured IncomeSM single premium immediate fixed annuity is what’s known as an income annuity. This product differs from other types of fixed annuities in that it immediately converts a large sum of cash into annuity payments. Annuity holders can choose to structure the annuity’s payments over one life, two lives or a specific timeframe. They can also choose the frequency of the payments and can receive them monthly, quarterly, annually or semi-annually.

Multi-Year Guaranteed Annuities

Another type of fixed annuity offered by LFG, the Lincoln MYGuaranteeSM Plus single premium deferred annuity, is what’s known as a multi-year guaranteed annuity (MYGA). This annuity offers a guaranteed initial interest rate for five to 10 years, with interest rates set annually after the initial interest period. The subsequent interest rates will never be lower than the initial rate. The fixed account interest paid by this MYGA is credited and compounded daily.

Fixed Index Annuities

LFG’s fixed index annuity offerings combine the security of fixed annuities with the growth potential of variable annuities. These products pay a guaranteed fixed interest rate and can earn additional money based on the equity market index they’re tied to.

Lincoln Financial Group’s fixed-indexed annuity products include:

- Lincoln OptiBlend®

- Lincoln Covered Choice® 5

- Lincoln Covered Choice® 5 II

- Lincoln Covered Choice® Advisory 5 II

- Lincoln FlexAdvantage®

Variable Annuities

LFG’s options for variable annuities give customers the opportunity to participate in equity market growth while guaranteeing a monthly income stream in retirement. The range of variable annuity products offered allows customers to choose from different features and benefits to find the plan that best suits their needs.

Lincoln Financial Group offers the following variable annuity products:

- American Legacy®

- American Legacy® Target Date Income

- Lincoln Investor Advantage®

- Lincoln Level Advantage®

- Lincoln ChoicePlus℠

Purchase an Annuity Today

Client Resources

Lincoln Financial Group annuity holders can view and update their annuity accounts online. If you need to file a claim for an annuity, you can do so online using LFG’s Lincoln i-Claim Process.

LFG provides online access to annuity forms including those for:

- Additional Deposit

- Authorization for Disclosure of Information

- Authorization for Release of Information

- Change of Beneficiary

- Power of Attorney Affidavit

- Qualified Annuity Claimants Statement

If you have an annuity with Lincoln Financial Group, you can log into your account at:

About Annuity.org

Annuity.org has provided reliable, accurate and trustworthy financial information to readers since 2013. We partner with professionals like those from Senior Market Sales (SMS), a market leader with over 30 years of experience in the insurance industry, to offer personalized retirement solutions for consumers across the country.

Any information offered about the company above is provided free of charge and individual product offerings are verified and accurate as of publication.

Our partners work with each of the provider companies mentioned on our site. However, Annuity.org is not a service provider. Actual products, terms and rates offered through the above company are subject to in-state availability and a variety of other factors. Visit the Our Partners page for additional information.