About SILAC Insurance Company

SILAC Insurance Company was originally founded as Equitable Life & Casualty Insurance Company in 1935. As Utah’s oldest active life insurance company, SILAC has provided products to meet the financial needs of retiring Americans for decades.

In the 1960s and 1970s, Equitable Life pioneered the development and marketing of Medicare supplement insurance and other supplemental health products. The company began selling annuity products in 2018, first offering fixed annuities and later offering fixed index annuities.

In 2020, the company changed its corporate name to SILAC Insurance Company in an effort to emphasize the greater variety of products it offered. Today, SILAC is licensed to sell insurance in 47 states and the District of Columbia and has grown its revenue to over $2 billion in annual sales.

SILAC annuity customers can contact an Annuity Customer Experience Specialist at one of the following numbers, depending on the type of annuity you own:

Fixed Indexed Annuities

888-352-5122

Multi-Year Guaranteed Annuities

888-889-0910

Credit Ratings

Companies that sell annuities receive credit ratings, also known as financial strength ratings, based on their overall financial stability. Independent credit rating agencies like A.M. Best give scores to annuity providers to give consumers an idea of how likely it is that the company will be able to meet its insurance obligations.

SILAC has a financial strength rating from only one major credit rating agency. AM Best gives SILAC a B+ score, which indicates a “good” rating of the company’s overall financial stability.

Annuities Offered by SILAC Insurance

SILAC Insurance Company offers two types of annuities to help their customers grow their retirement savings. The company’s fixed index annuities offer greater potential for accumulation, while its multi-year guaranteed annuity products provide predictable, steady returns.

Fixed Index Annuities

The majority of SILAC’s annuity offerings are fixed index annuities (FIAs). This type of annuity helps consumers reach their retirement savings goals while insuring their savings against financial risks like market volatility. The interest an FIA accumulates is tied to the growth of an equity market index, but the product still pays a minimum fixed rate no matter how the index performs.

SILAC offers three groups of FIA products to help consumers choose an annuity that best suits their needs. The Vega series is focused on the accumulation of retirement income, with a variety of income and benefit options annuity owners can customize for their unique situation.

SILAC’s Denali series offers both accumulation and guaranteed lifetime income but still provides flexibility. Denali annuity owners can choose from seven-, 10- and 14-year accumulation periods depending on their needs.

Finally, the SILAC Teton series provides up to eight indexed crediting options along with a fixed interest rate, meaning that annuity owners can strategize which index will provide the greatest return on their investment. Teton FIA products also come with annual free withdrawal, cumulative withdrawal, wealth transfers and other benefits automatically included at no extra charge.

Multi-Year Guaranteed Annuities

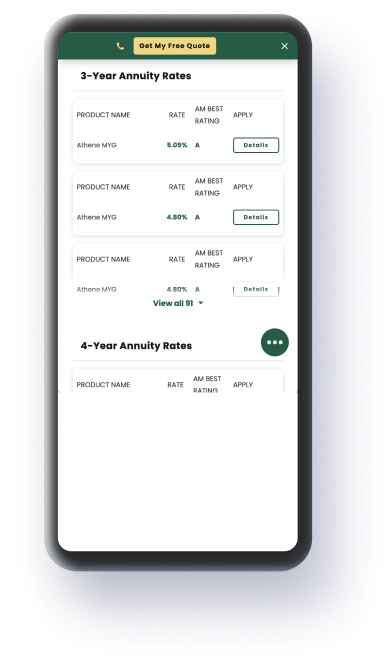

For consumers who want an even more reliable rate of return, SILAC offers multi-year guaranteed annuity (MYGA) products. These annuities offer a guaranteed fixed rate of return for a set number of years. They’re not tied to the performance of the equity market like an index annuity, and many MYGAs allow the owner to withdraw a certain amount from the contract each year.

SILAC’s Secure Savings and Secure Savings Elite MYGA products offer competitive fixed interest rates. Customers can choose a two-year or five-year rate guarantee period when purchasing the annuity. These MYGA products also come with annual free withdrawals, plus the benefits of full account value at death and spousal continuation included free of charge.

Purchase an Annuity Today

Client Resources

To help address their clients’ unique needs, SILAC employs a team of what they call Annuity Customer Experience Specialists (ACES). These specialists provide personalized services to SILAC customers and can be reached via phone, by e-mail or in writing.

Additionally, SILAC customers can access relevant annuity forms online:

- Request to Change Beneficiary Form

- Annuitant-Ownership Service Form

- Annuity Death Claim Form

- Systematic Withdrawal Form

If you have an annuity with SILAC Insurance Company, you can log into your account at:

About Annuity.org

Annuity.org has provided reliable, accurate and trustworthy financial information to readers since 2013. We partner with professionals like those from Senior Market Sales (SMS), a market leader with over 30 years of experience in the insurance industry, to offer personalized retirement solutions for consumers across the country.

Any information offered about the company above is provided free of charge and individual product offerings are verified and accurate as of publication.

Our partners work with the provider companies mentioned on our site. However, Annuity.org is not a service provider. Actual products, terms and rates offered through the above company are subject to in-state availability and a variety of other factors. Visit the Our Partners page for additional information.