About Jackson National Life Insurance

Jackson National Life Insurance was originally founded in 1961. As the name suggests, it sold life insurance for much of the company’s history but discontinued those products in 2012.

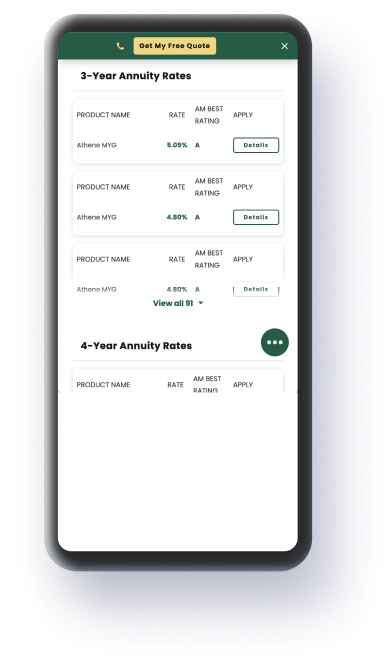

Today, Jackson National deals primarily in annuities. The company ranked No. 1 for total annuity sales in 2021, providing numerous types of annuity products. Net income exceeded $3 billion in 2021.

According to the company, Jackson National ranked No. 31 or higher in the U.S. among providers for sales of variable annuities, fixed-rate deferred annuities and fixed indexed annuities in 2021. That included leading all companies in variable annuity sales.

Jackson National advertises its products as a way to help Americans avoid potentially outliving their money and secure their financial status.

Types of Jackson National Life Insurance Products

While Jackson National no longer sells any life insurance products, it offers several different types of annuities. The options do vary from annuity to annuity, with the company typically offering various add-on benefits that can help to mitigate risk or provide more security.

Variable Annuities

One of the main products that Jackson National Life Insurance offers are variable annuities. This option does come with risk, since it involves investing your annuity to help it grow.

The potential for serious reward is present since a variable annuity can grow quickly in a strong market, but there is significantly more risk since the annuity could also lose more value quickly.

Jackson National Life Insurance offers add-on benefits that can be purchased with a variable annuity to help mitigate some of the risk.

Registered Index-Linked Annuities

Jackson National Life also offers registered index-linked annuities (RILA). This type of product functions similarly to a variable annuity in that it can grow with a growing market.

A registered index-linked annuity is tied to the growth of an index, like the S&P 500. So, if that index grows, the annuity grows. If the index is not doing well, the annuity may suffer as well.

But this type of product does offer more innate security than a variable annuity, since you can set a floor of how much loss you are willing to take. This can help to prevent you from ending up with nothing or the annuity losing its total value.

The trade-off is that there may be a cap on how much the annuity can grow, even if the market it is tied to exceeds that cap. Less risk can be attractive, but a registered index-linked annuity also may have less potential for growth than a variable annuity.

Fixed Index Annuities

Fixed index annuities are another product that Jackson National Life Insurance currently offers. Similar to registered index-linked annuities, a fixed index annuity is tied to the performance of an index.

It works as a middle ground between fixed annuities and variable annuities, allowing you to participate in and benefit from market growth without all of the inherent risk that comes with a variable annuity.

The annuity includes protection against losses in exchange for a cap on potential earnings. That protection can be in the form of a guaranteed minimum return, meaning you can have an earning floor set above 0%.

That way, even if the index your annuity is invested in loses value, you can still see growth.

Fixed Annuities

Jackson National Life Insurance offers fixed annuities as well, which is cited as a conservative option that avoids the volatility of investing in the stock market altogether.

Fixed annuities grow at a set or fixed rate. They are not tied to market performance or some other form of investment. They simply continue to grow at the predetermined rate.

Fixed annuities come with very little risk and can serve as a straightforward way to accumulate, but the lack of risk means that the potential for reward and significant gains is also much lower.

Purchase an Annuity Today

Pros and Cons of Jackson National Life Insurance

There are both advantages and disadvantages to purchasing a financial product from Jackson National Life Insurance.

One of the company’s pros is the variety of annuity options. The company offers numerous different types that cater to different audiences, with those options able to be further customized with add-on benefits.

Another advantage of the company is the security that comes with its age and size. Jackson National has been around for decades and is consistently one of the biggest sellers of annuities in the U.S. The company also generally receives good financial ratings.

But a potential drawback of the company is its limited scope. Despite its name, Jackson National does not currently sell any life insurance products.

Its focus is largely limited to annuities, where other companies may offer a wider range of financial products.

Ratings and Rankings of Jackson National Life Insurance

Jackson National Life Insurance typically receives strong financial ratings. According to its website, the company has received a financial rating that ranges from good to excellent from all major independent ratings agencies in 2022.

The company benefits from its age and decades of selling financial products.

Financial Strength Ratings

| Ratings Agency | Jackson National Life Insurance Rating |

|---|---|

| AM Best | A (Excellent) |

| Fitch | A (Strong) |

| Standard & Poor’s | A (Strong) |

| Moody’s | A2 (Good) |

As of 2021, the company ranks highly in several sales categories as well according to its website. Jackson National Life Insurance remained the No. 1 overall seller of annuities that year, as well as the No. 1 seller for variable annuities.

The company also ranked in the top 20 in life insurance company rankings in total statutory assets and general account assets.